|

|

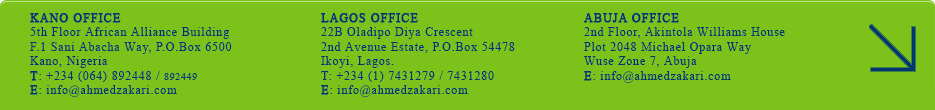

terms & conditions | contact us | email |

|

Islamic Modes of Financing - Part 1

There are many Shariah compliant modes of financing adopted in the day to day operations of Islamic financial Institutions. These modes of financing can be classified based on conceptions and principles as well as on business applications. With respect to the level of their compliant with the principles of Shariah, we can classify the modes of financing into Shariah based and Shariah compliant. While modes of financing such as Musharakah (partnership or profit and loss sharing), Mudarabah (profit sharing) and bay' salam (advance payment sale) are Shariah based, Murabahah (cost plus margin sale), Bai Bithamin Ajil (BBA - deferred payment sale) and Tawarruq (contract of seeking cash) are some of the examples of Shariah compliant Islamic modes of financing.

In terms of application, however, we have the following classifications: equity, trading, leasing, gratuitous and supporting (or fee based) banking contracts and modes of financing. Musharakah, Mudarabah and Musharakah Mutanaqisah (Diminishing partnership) are examples of Equity banking products while Ijarah (Leasing) and its various kinds are good examples of leasing banking products. Trading modes of financing, in its case includes such products as Murabahah, Istisna', Salam (forward sale), BBA and Tawarruq (cash seeking). Gratuitous contracts consist Waqf, Ibra' (commission) and loan while supporting modes of financing are Wakalah (Agency), Kafalah (suretyship), Wadiah (safekeeping), Rahn (pledge or collateral), etc. Meanwhile, the following passages shall focus on concise explanation or descriptions of some of the above mentioned Islamic modes of financing. It should be mentioned at this juncture that these modes of financing can be used to facilitate products such as deposit services, consumer banking, corporate banking, project or trade financing, etc. The detailed explanations of the modes of financing shall be discussed in our subsequent presentations. Murabahah: Murabahah is a mode of financing that is otherwise referred to as cost plus mark-up sale. It is a sale at an agreed profit margin and remains one of the most prominent forms of Islamic mode of financing. Operationally, an Islamic financial institution for instance purchases a specific commodity on the request of a client or customer. Subsequently, the customer then purchases the commodity from the Islamic financial institution on an agreed price that is structured to include the cost of purchasing the commodity, the risk undertaken in the process and of course a profit margin. The transaction is done on a deferred payment basis wherein the customer pays back over a stipulated period of time on the basis of instalment. This mode of financing is widely adopted and applied by Islamic financial institutions. Musharakah: Another important Islamic mode of financing is Musharakah - derived from the term "Shirkah - Partnership". Musharakah means equity participation or profit and loss sharing or even partnership. In this type of arrangement, both parties, the institution and the client (or investors) provide capital under flexible contractual conditions to invest in a business and thereof share the returns from such business or investment. This mode of financing is not widely applied by Islamic banks as it is alleged to be highly risky. Nonetheless, Musharakah is said to be suitable for joint venture investments and could as well be used to package portfolios of assets whose, for example returns, real property lease payments and the likes can be subsequently shared among the partners. Mudharabah: Actually, Mudharabah is a special form of Musharakah because it involves profit sharing. Mudharabah means participation financing structured by contemporary Islamic financial institutions as a way of providing fund management services that falls within the principles of profit and risk sharing. It involves two parties namely Rabbul Mal (i.e financier) and Mudharib (fund manager). Most Islamic financial institutions adopt Mudharabah as a viable mode of financing. Widget is loading comments...

|

|

||

| © 2011 Ahmed Zakari & Co. All rights reserved. |